Today’s post is a Q&A all about accepting payments online. We demystify the world of online payment processing. You’ll be accepting payments in no time!

What is a payment processor or gateway? What should I be looking for when researching the options? Do I need more than one?

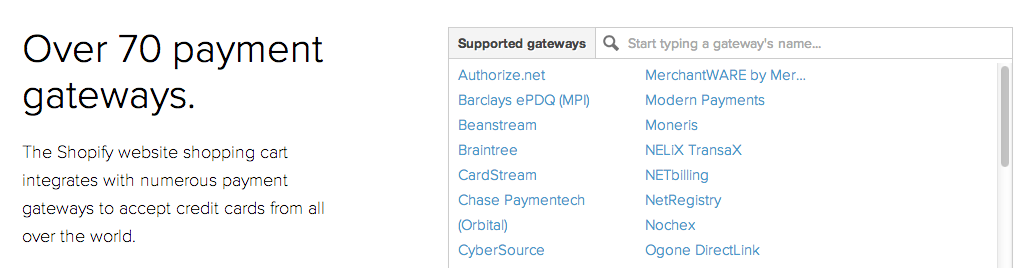

Payment options can be downright overwhelming, especially given the sheer number of them. Shopify, one of our favorite e-commerce systems, currently supports more than 70 different options for handling payments.

The benefit to this huge number of available gateways is that it makes it pretty easy for sellers who already run payments through a variety of banks and other processors, a common situation for bricks-and-mortar stores that are making the leap to also sell their products online.

The downfall, of course, is that a list that long can be pretty paralyzing if you aren’t sure what to look for.

I tend to talk about payment options as falling into one of three categories:

- Credit card processors

- Customer account-based methods

- Manual methods

Most e-commerce platforms, Shopify included, allow you to select at least one option from each of those categories, which then gives your customer a choice of how they want to pay.

1. Credit Card Processors

If you’d like to accept credit cards directly (not just through PayPal, for example), you’ll need to sign up for an account with a credit card processor. This is typically what we mean when we talk about “payment processors” (although that’s technically a more blanket term). Most credit card processors charge a variety of fees, and some also require that you use a specialized bank account called a “merchant account.”

Authorize.net is a well-known option for processing payments online, and their pricing model includes a $99 setup fee and a $20/month account fee, in addition to transaction fees ($0.10 for every transaction, which means every authorization, refund, decline, etc.), and “batch fees,” which are charged each time a batch of settled transactions is run through their system.

My Recommendation: Stripe

Something of the new kid on the credit card processing block, Stripe is currently available for sellers in the US and Canada, although payments can be accepted from anywhere. Stripe charges only by the transaction, using a model similar to PayPal – at the time of this post, it’s 2.9% + 30 cents per successful charge – and profits are deposited directly into your bank account on a rolling basis 7 days after each transaction. Its ease of use, strong dedicated support team, and clean interface make Stripe a clear winner for most small businesses that want to start accepting payments online.

2. Customer Account-Based Methods

Most people who spend any time shopping online are familiar with PayPal, a system that I consider “customer account-based” because the customer already has an account making it easy for them to click the PayPal payment button and pay without having to dig out a credit card or enter a bunch of billing information. Google Checkout is a similar account-based method.

The great benefit to account-based payment methods is convenience – lowering the barrier to completing a transaction is almost always a good thing. They also usually handle much of the security needs for payment processing on their sites, which can be reassuring for both customers and merchants, and they are typically very easy to integrate into e-commerce systems.

The downside of systems like PayPal is that they typically pull the customer off of your website to complete the transaction. They can also be confusing for people who aren’t familiar with them, especially when they’re used to processing regular, non-account-holder credit card payments. Finally, PayPal’s record for providing support for merchants is somewhat tarnished, and their system gives quite a bit of power to buyers in terms of making claims if something goes wrong in the transaction.

My Recommendation: Double Up

I do think it’s usually worth giving buyers the option to pay with PayPal – the convenience factor may be the key to converting sales for some of your customer base. However, I would recommend using PayPal in addition to a regular credit card processor such as Stripe so that your customers who are using credit cards can stay on your site to complete their purchases. Using another processor also gives you some flexibility if you ever do run into issues with PayPal – it’s always a good idea to have a backup!

3. Manual Payment Methods

In addition to accepting credit cards and/or PayPal, most e-commerce platforms allow you to set up any of a number of manual payment processing options. You can accept mailed checks or money orders, direct bank transfers, or perhaps have the option to pay for an order in-store. Typically, you just give your manual payment method a name and include a set of instructions for your customers, and they can select it like any other payment option.

My Recommendation: Skip It

Unless you are also handling delivery in person, accepting checks or other manual payment methods typically doesn’t make sense for online sellers. If you do offer pick-up and are set up for handling cash payments, it could be an acceptable option, but you are still setting yourself up for a certain degree of risk in that your inventory will lower before you have any way of verifying payment.

Share your thoughts about accepting payments online!

The world of payment processing and accepting payments online seems overwhelming, and it certainly gets more complex for sellers who also need to handle in-person sales through a Point-of-Sale system (whether at a store location or at craft fairs). Fortunately, companies like Stripe are introducing some competition into what was previously a fairly stale market, and making it so that you can set up multiple payment options for your customers without breaking your own bank.

Of course, we’re always game to discuss the details of your particular business to help you figure out the right solution for your needs, and we happily handle all the integrations between processor and e-commerce system for our clients, so if you’re still feeling confused give us a shout!

[Arianne’s note: shop owners, what payment methods do you have experience with? Any glowing recommendations or horror stories for others? We’d love to hear!]

Savvy creative businesses say they always learn something helpful and interesting when they read our newsletter! You can join them here.

A Newsletter That Goes Beyond Shopify 101

It’s easy to find beginner info about ecommerce online. If you’re past that? Subscribe to our newsletter for advanced strategies and need-to-know info for established shops. You'll get:

- Weekly tips to help you market and sell your products

- Updates when there is news that may impact your site

- Round ups of interesting links and info for brands

- Invites to our live trainings and webinars

- Instant access to our past emails

Browse Posts

A Newsletter That Goes Beyond Shopify 101

It’s easy to find beginner info about ecommerce online. If you’re past that? Subscribe to our newsletter for advanced strategies and need-to-know info for established shops.

Learn how the top shops grow:

"*" indicates required fields

1 thought on “Q&A: Accepting Payments Online”

Leave a Comment

Related Posts

Let's take your online shop to the next level

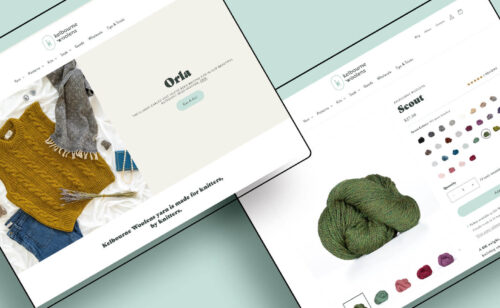

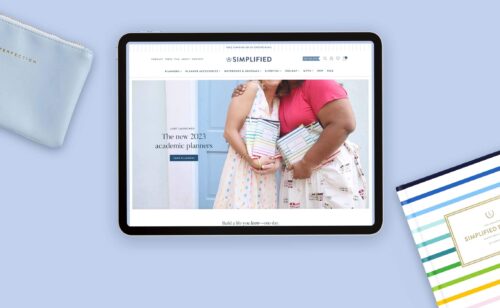

The Shopify websites we design have a reputation for substantial improvements to ecommerce conversion rates and online sales. Let's talk!

Grab my guide to the 10 main ways to grow traffic and optimize to boost sales.

Grab my guide to the 10 main ways to grow traffic and optimize to boost sales.

Thank you for this valuable information. I have a Clover POS from Wells Fargo but I don’t think I can use it for online transactions. I am in the process of moving and everything is on hold until this is finished. Then I will sit down with my banker and figure all this out.

I look forward to reading your posts, I think they will help me navigate all the in and outs and by pass the pit falls.

Sheryl